News

Cybertruck Sale Surges to $244K at Auction, Posing Questions for Tesla's Resale Rules

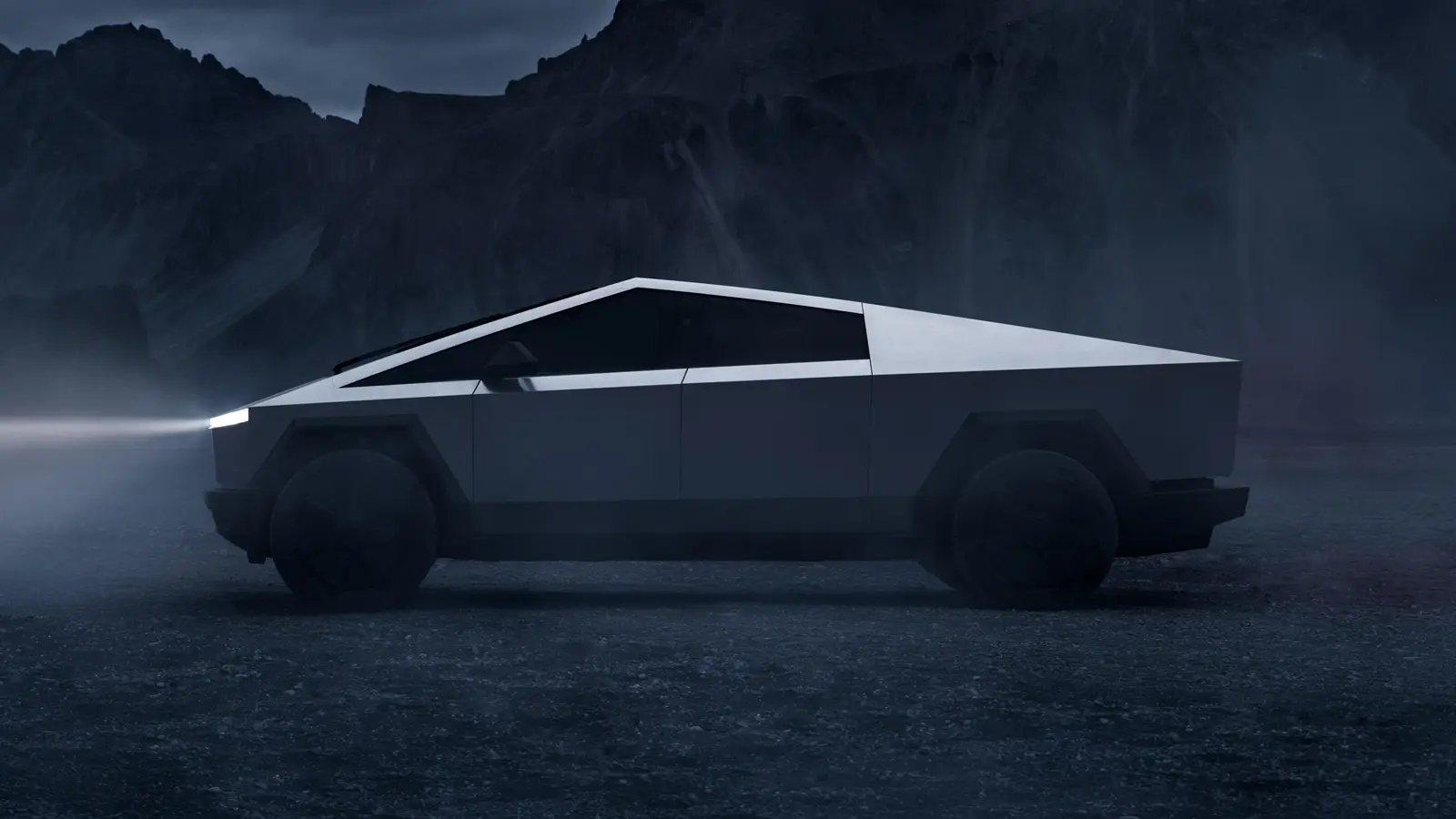

A Tesla Cybertruck sold for $244,000 at auction, over double its MSRP, to a Porsche dealer, raising questions about Tesla's resale restrictions.

This sale, executed through Cox Automotive’s Manheim wholesale site, saw the Cybertruck fetching more than double its Manufacturer's Suggested Retail Price (MSRP), with the winning bid placed by Porsche of South Orlando. The transaction raises questions about the profits from this sale and its potential implications for the market and other Cybertruck owners.

The auctioned Tesla Cybertruck, a model from the Foundation Series equipped with all-wheel drive, had an original base price of approximately $120,000. The sale price, therefore, represents a substantial premium, indicating the high demand and enthusiasm surrounding Tesla's innovative electric truck. This scenario could significantly benefit the seller, potentially yielding a hefty profit margin. However, the situation is complicated by Tesla's unique stance on the resale of its vehicles.

Tesla's sales agreement for the Cybertruck includes a clause that mandates owners to offer the company the right of first refusal if they wish to sell the vehicle. According to this agreement, the original buyer must first request Tesla to buy back the vehicle before attempting to sell it on the open market. This stipulation aims to prevent speculative reselling and flipping for profit, a practice Tesla seeks to curb. The penalty for breaching this agreement is severe, with Tesla entitled to either a $50,000 fine or the total profit from the resale, whichever is higher. This clause could potentially impact the seller's ability to retain the substantial profits from this auction.

The enforcement of this clause, and its legal standing, remains untested, as there are no known instances of Tesla pursuing action against individuals reselling their vehicles in violation of the agreement. This sale, therefore, presents a fascinating case study on Tesla's policies against vehicle flipping and its efforts to control the secondary market for its vehicles.

The significant markup achieved in this auction not only highlights the Cybertruck's desirability but also underscores Tesla's unique position in the automotive industry, where its policies against resale markups appear more effective than those of other manufacturers. As the market for electric vehicles continues to grow, and with the Cybertruck's production ramping up, the implications of this sale and Tesla's policies will be closely watched by industry observers, potential sellers, and Tesla itself. Whether this will deter or encourage more high-profile resales remains to be seen, but it undoubtedly adds an intriguing layer to the narrative of Tesla's market influence and control.

Dave Mulder

2024, Feb 29 00:33